Product - Coming Soon

AI First Bank

Industry

Banking

Year

2025

Client

Banky

Designing an AI First Digital Bank That Thinks Ahead

Most digital banks still behave like static dashboards. They show balances, transactions, and charts, but leave the actual thinking and decision making to the user. From the start, we set out to design something fundamentally different.

We designed an AI first digital bank that acts less like a tool and more like a financial thinking partner. Our goal was to create a system that proactively works on behalf of the user, helping them earn more from their existing cash while removing the constant mental overhead of managing accounts, bills and balances.

Designing for how money actually works

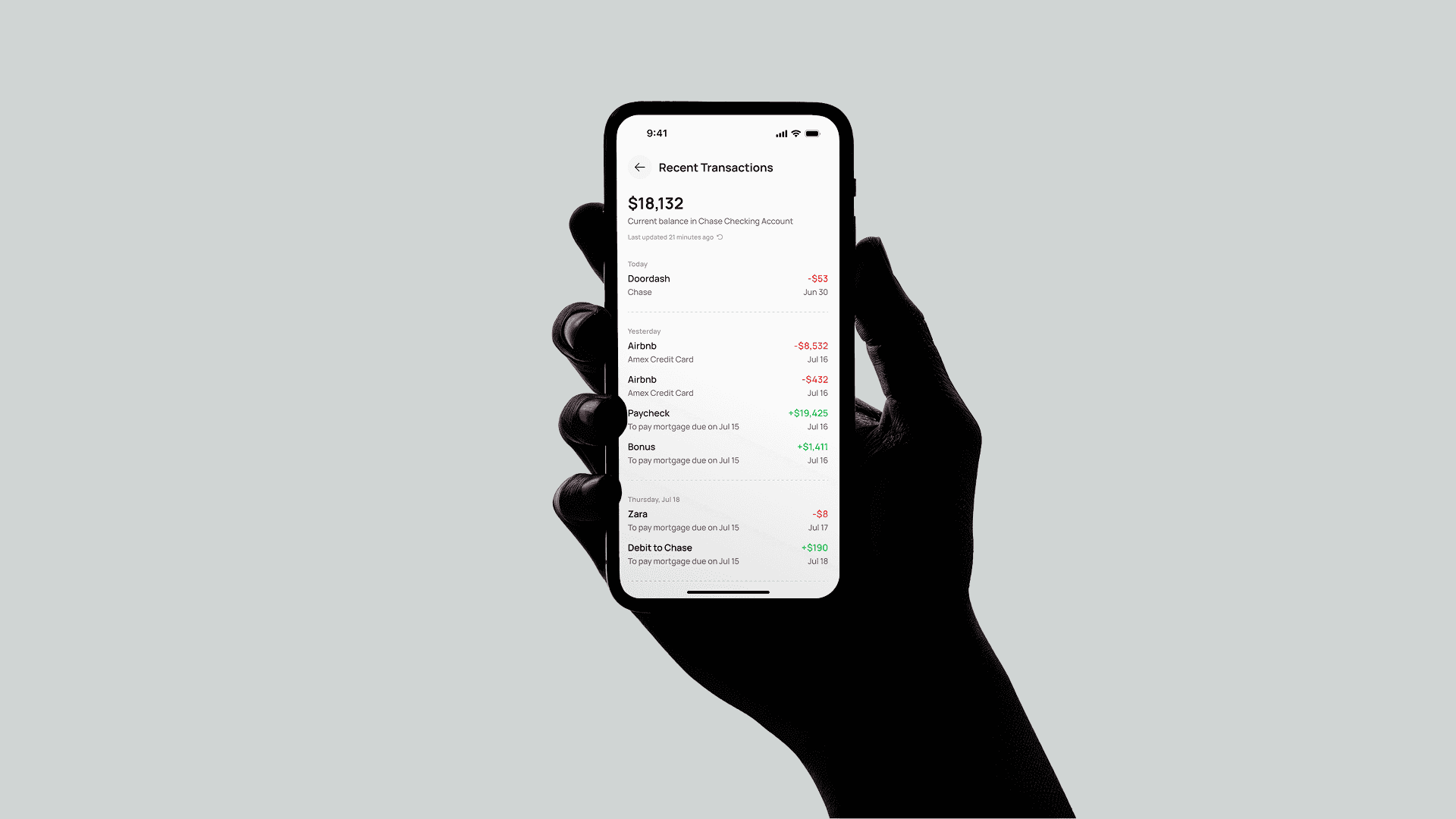

People do not manage money in a single place. Cash is spread across multiple checking and savings accounts, bills are paid on different schedules, and income arrives in irregular patterns. In most products, this complexity is exposed directly to the user, resulting in more controls, more alerts and more manual effort.

Instead of asking users to adapt to the product, we designed the product to adapt to the user’s existing financial setup. We built a system that sits on top of their current banks through secure account linking and regulatory compliant onboarding, giving it a complete and real time view of their financial landscape

This foundation allowed us to shift the product away from passive reporting and toward active decision making.

Moving beyond balances and budgets

Rather than showing static logs of transactions or rigid budget categories, we designed the product to continuously interpret financial patterns. The system understands income cadence, recurring bills, spending behavior, and idle balances. It anticipates what money needs to stay liquid and what money can be put to work.

We deliberately limited the number of decisions users need to make. Users set simple guardrails, such as a cash buffer and their recurring bills and the system handles the rest. This approach reduces anxiety while preserving a strong sense of control.

Automation in this context is not about speed or convenience alone. It is about removing unnecessary decisions without removing understanding.

Making automation feel trustworthy

One of the biggest risks in financial automation is loss of trust. To address this, we designed every automated action to be predictable, explainable and visible in advance.

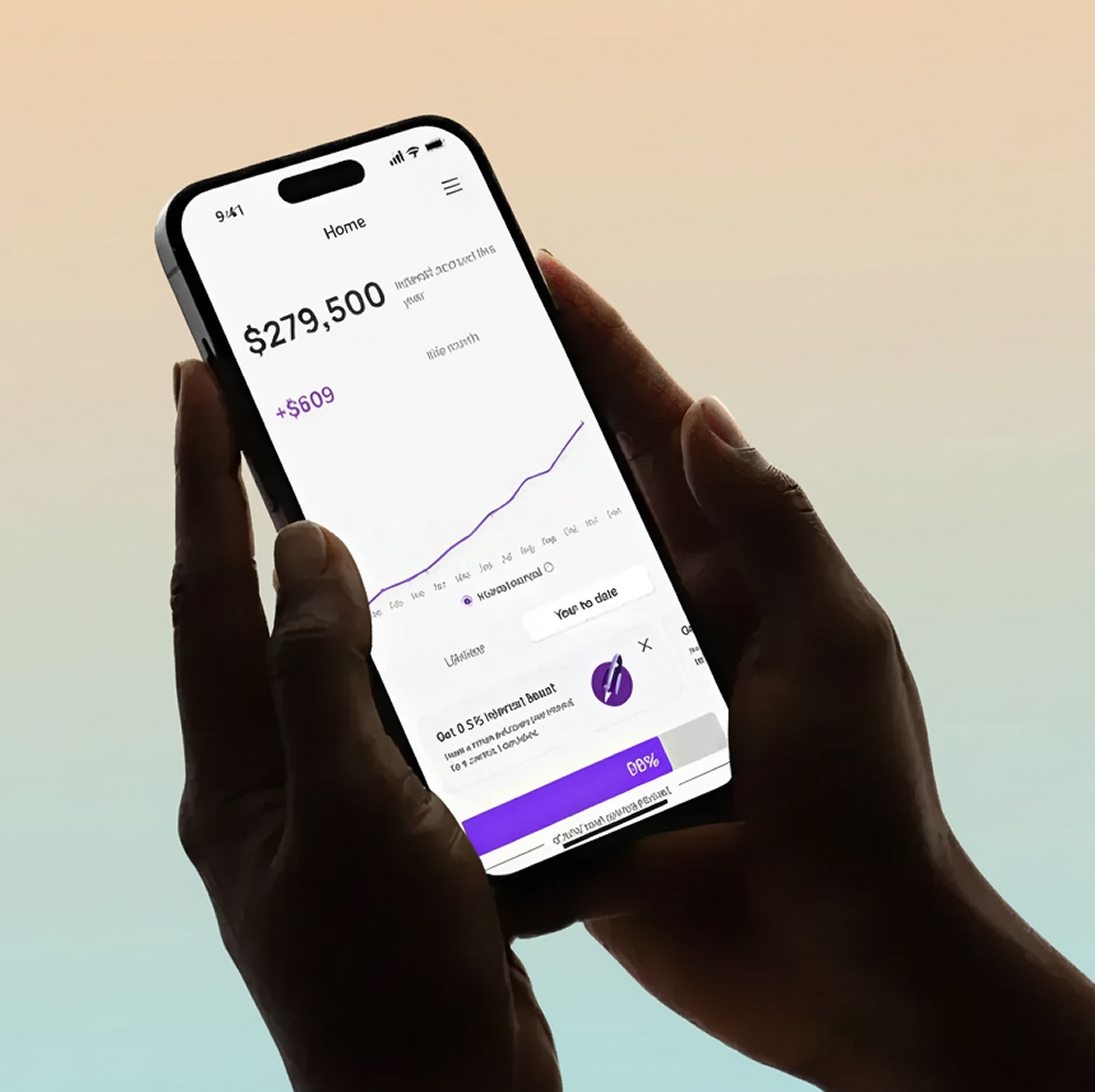

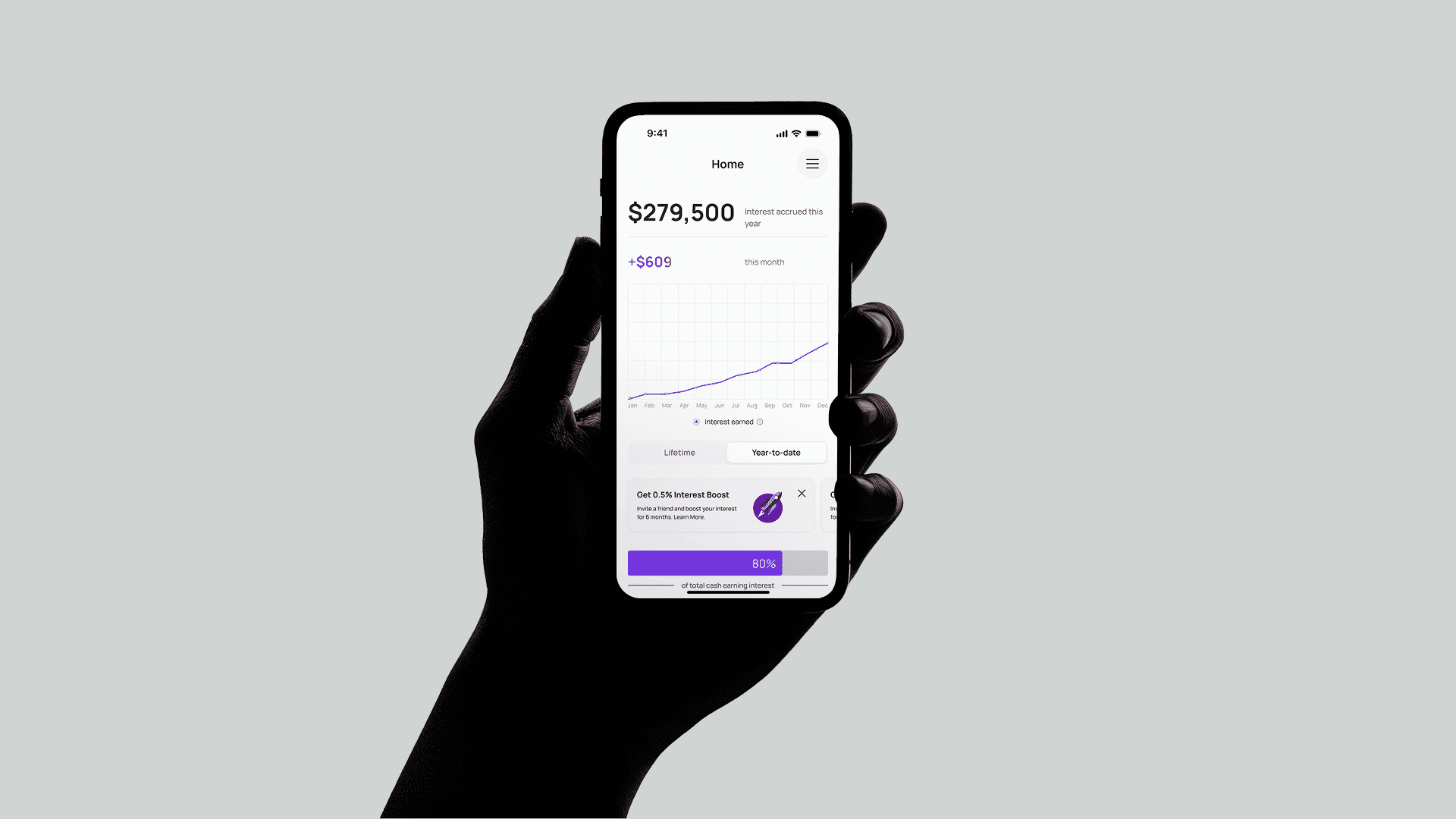

This thinking led to the design of the Yield Plan. Once enabled, the system automatically moves idle cash into yield generating accounts while ensuring that upcoming bills are always covered. Users can review upcoming transfers, adjust buffers at any time and see exactly how much of their total cash is actively earning interest.

By surfacing intent instead of raw activity, we made automation feel like a feature users can rely on rather than something they have to monitor constantly

Designing clarity into every interaction

Across the product, we were intentional about reducing cognitive load. Notifications are used sparingly and only when something meaningful changes. Screens focus on outcomes rather than mechanics. Even complex flows such as identity verification, account disconnections, or plan deactivation are designed with clear language and reassurance.

At every step, the experience answers three questions for the user. What is happening, why it is happening and what control they have if they want to intervene.

This consistency builds confidence over time and allows users to trust the system without feeling detached from their money.

Keeping AI out of the spotlight

Although AI drives the intelligence of the product, we deliberately kept it out of the foreground. There are no bots to manage or prompts to configure. Intelligence is embedded directly into the flow of the experience, making the product feel thoughtful rather than technical.

The interface stays clean, calm and human, allowing users to focus on results instead of complexity.

The outcome

By combining intelligent automation, rigorous financial logic and careful experience design, we created a digital bank that transforms idle cash into an active asset. More importantly, we designed a system that earns trust gradually, works quietly in the background and helps users make more money without having to constantly think about money.